As the year draws to a close, small business accounting becomes one of the most important priorities for business owners. Reviewing your books and planning for the year ahead isn’t just about balancing numbers; it’s about understanding where your money went, where it should go next.

Year-end budgeting gives you a clear view of your business’s financial health, helps identify hidden costs, and sets the stage for smarter decisions in the coming year. Whether you’re managing growth, tightening expenses, or preparing for tax season, a well-structured budget can turn financial data into strategy.

In this guide, you’ll find smart budgeting tips for small business accounting at year-end; practical, actionable steps to help you close the books confidently and start the new year with clarity and control.

1. Review Your Current Financial Statements

Before you can plan for the next year, you need a clear picture of where your business stands today. Start by reviewing your income statement, balance sheet, and cash flow statement; the foundation of effective small business accounting.

These financial reports show your revenue, expenses, assets, and liabilities; everything you need to assess your business’s financial health.

Pay close attention to:

• Trends in revenue: Has your income been steady, growing, or fluctuating?

• Expense patterns: Which costs increased unexpectedly this year?

• Outstanding debts: Are there loans or credit card balances that need priority repayment?

A detailed year-end review helps identify both strengths and inefficiencies in your current operations. If you’re using accounting software like QuickBooks, Xero, or Zoho Books, generate reports to make this process faster and more accurate.

2. Separate Fixed and Variable Expenses

Understanding your expense structure is a key part of small business accounting. Start by dividing your costs into two categories:

• Fixed expenses: These remain consistent each month, such as rent, insurance, software subscriptions, loan repayments, and employee salaries.

• Variable expenses: These fluctuate depending on business activity or revenue, for example, utilities, raw materials, or marketing costs.

Once categorized, analyze which variable costs can be optimized. Look for areas where spending can be reduced without affecting quality or performance.

Setting spending limits for discretionary expenses like marketing or travel ensures better control over your cash flow in the new year.

3. Forecast Realistically Based on Data

A common mistake in small business accounting is relying on rough estimates instead of actual data. Use your previous year’s financials to project realistic figures for the coming year.

To forecast effectively:

• Review at least 12 months of revenue and expense trends.

• Identify seasonal fluctuations or busy periods that affect cash flow.

• Consider expected changes, such as price adjustments, new hires, or equipment purchases.

It’s better to underestimate income and overestimate expenses when budgeting. This gives you a financial cushion and prevents surprises during slower months.

4. Build an Emergency Reserve

Unexpected expenses can arise anytime, from equipment breakdowns to delayed client payments, and they can quickly disrupt your cash flow. Building a financial safety net helps your business stay resilient and strengthens small business accounting stability.

Here’s how to create one effectively:

• Set a target reserve: Aim to save at least three to six months of operating expenses in a dedicated account.

• Keep it separate: Store these funds in a business savings account to avoid accidental use.

• Start small if needed: If cash flow is limited, begin by saving a small percentage of monthly profits and increase contributions gradually.

• Use only for real emergencies: Treat this reserve as off-limits except during critical financial disruptions.

• Review annually: Reassess your reserve size each year to ensure it aligns with business growth and new expenses.

• Automate transfers: Schedule regular automatic transfers to your savings account to stay consistent.

A well-maintained emergency reserve provides financial stability, peace of mind, and confidence to handle unexpected challenges.

5. Evaluate and Update Your Accounting Software

The year-end is the perfect time to review your accounting tools and ensure they’re supporting your business effectively. Strong systems play a key role in small business accounting success.

Here’s what to do:

• Assess your current system: If bookkeeping feels slow or disorganized, it may be time for an upgrade.

• Consider cloud-based solutions: Platforms like QuickBooks Online, Xero, or Zoho Books automate tasks such as invoicing, expense tracking, and reconciliation.

• Take advantage of real-time access: Cloud accounting lets you view up-to-date financial data, collaborate easily with your accountant, and ensure secure data backups.

• Perform a year-end cleanup: Update software versions, remove outdated records, and archive old files to keep your books accurate and clutter-free.

• Check for automation and AI features: Look for tools that offer automated bank feeds, AI-driven reconciliation, and smart expense categorization to save time and minimize errors.

Regular software reviews keep your year-end accounting efficient, compliant, and ready for growth.

6. Reconcile and Review All Accounts

Before closing your books, make sure all your accounts match, from bank balances to credit card statements. Reconciliation is essential in small business accounting because it helps identify errors, missing entries, and any mismatches between your books and external statements.

Steps to follow:

Accurate reconciliation prevents audit issues later and helps you start the new year with clean, trustworthy financial data.

7. Reassess Your Tax Strategy

Tax planning is a crucial part of small business accounting and should never be a last-minute task. The year-end period is ideal for reviewing deductions, credits, and potential tax savings.

Meet with your accountant or tax advisor to discuss:

If you’ve had a strong financial year, consider making last-minute investments or prepaying expenses before December 31 to reduce taxable income. Taking a proactive approach to year-end tax planning can unlock meaningful savings when it’s time to file.

8. Set New Financial Goals for the Next Year

A well-structured budget helps small businesses plan beyond immediate needs. Setting new goals keeps your small business accounting future focused.

Consider targets such as:

• Increasing net profit by a specific percentage.

• Reducing overhead costs by streamlining operations.

• Improving accounts receivable turnover by tightening payment terms.

• Building a stronger emergency reserve or reducing existing debt.

• Expanding products or services to reach new customer segments.

Use these goals to guide your monthly and quarterly budget. Review progress regularly and adjust plans if actual results differ from projections.

9. Don’t Overlook Employee Costs and Benefits

Labor costs often make up a significant portion of small business budgets. As you plan your year-end finances, review all employee-related expenses carefully.

Here’s what to include:

• Evaluate payroll and performance: Ensure salaries reflect employee performance and align with market standards.

• Update payroll records: Verify that all employee data, tax withholdings, and payment details are accurate and up to date.

• Plan for upcoming changes: Account for raises, bonuses, or new hires in your upcoming year’s budget.

• Review benefits programs: Reassess health insurance, retirement plans, and other employee benefits to ensure they’re current and properly budgeted.

• Track total labor costs: Confirm that all payroll and benefit expenses are accurately reflected in your budget to avoid future cash flow surprises.

10. Consult an Accountant Before Finalizing the Budget

Even if you manage most bookkeeping internally, professional guidance adds tremendous value to small business accounting.

Benefits of Hiring Accounting Services for Small and Growing Businesses includes saving time, ensuring compliance, uncovering tax-saving opportunities, and gaining data-backed financial clarity that supports sustainable business growth.

Here’s why it matters:

• Identify missed deductions: Accountants can uncover expenses you might have overlooked and help you maximize tax savings.

• Improve financial strategy: Get expert advice on streamlining operations, managing cash flow, and optimizing profits.

• Ensure alignment with long-term goals: A professional can verify that your budget supports both short-term needs and future growth plans.

• Make data-driven decisions: An external review offers objective insights, helping you plan based on facts rather than assumptions.

• Prepare for sustainable growth: Schedule a year-end consultation to assess tax implications and confirm your budget is ready for the year ahead.

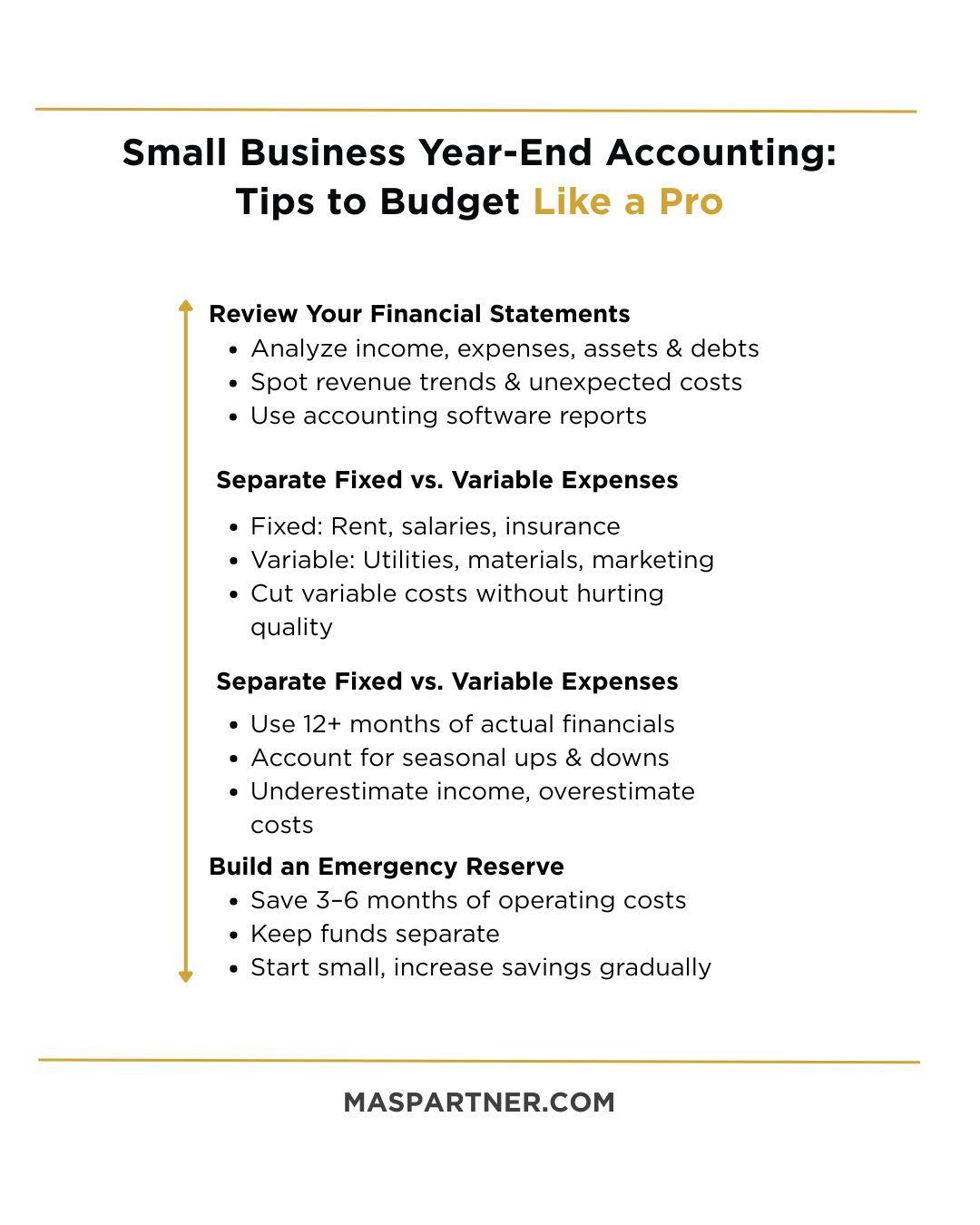

Before we wrap up, here’s a quick visual summary of the budgeting steps you can use at year-end:

Final Thoughts

Smart budgeting is more than a year-end task; it’s an ongoing discipline that strengthens small business accounting and supports business growth. Review your financials, building reserves, and refining tax strategies to safeguard your company’s future.

By using the right accounting tools, tracking expenses effectively, and setting realistic goals, you can turn your year-end accounting into a powerful planning opportunity.

If you’d like expert assistance in setting up your year-end accounts, refining your budget, or planning for the next financial year, our team can help. Book your free consultation today and start the new year with confidence and control over your business finances.

FAQs

1. Why is year-end accounting important for small businesses?

Year-end accounting is essential for small business accounting because it helps assess your financial health, prepare accurate tax filings, identify savings opportunities, and plan budgets for the year ahead. Strong year-end accounting also supports better decision-making.

2. What financial statements should I review before year-end budgeting?

Review your profit and loss statement, balance sheet, and cash flow report. These reports give a clear picture of profits, liabilities, and spending patterns, helping strengthen accounting for business as you prepare next year’s budget.

3. How do I separate fixed and variable expenses for budgeting?

Fixed expenses (like rent and insurance) remain consistent, while variable expenses (such as utilities or supplies) change with business activity. Separating them improves budget accuracy and supports effective small business accounting.

4. How can accounting software help with year-end bookkeeping?

Accounting software automates reconciliations, tracks expenses, generates financial reports, and reduces manual errors. It also complements accounting services and makes the workflow smoother during year-end cleanup.

5. When should I consult an accountant during year-end accounting?

Consult an accountant before closing the books. A professional offering accounting services can verify accuracy, identify deductions, and help you prepare for upcoming tax obligations, ensuring your small business accounting stays compliant and efficient.