INTRODUCTION

Three businesses. Three sets of incomplete books. One sudden service collapse.

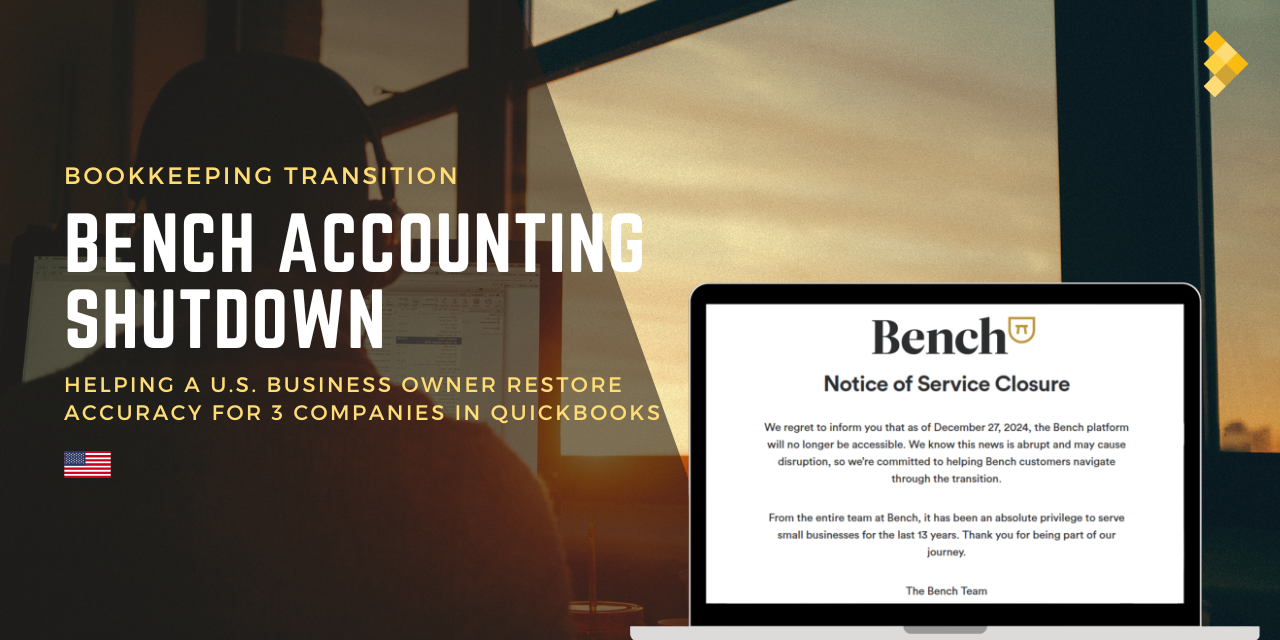

A U.S.-based business owner managing three separate entities faced an unexpected challenge when their bookkeeping provider, Bench Accounting, shut down operations. The abrupt halt left all companies with uncategorized, incomplete, and poorly maintained records. The client urgently needed a dependable accounting partner to restore order and ensure ongoing accuracy.

DISCUSSIONS

When Bench ceased operations, the client was left with a significant backlog of disorganized transactions and unreconciled accounts. Their QuickBooks Online (QBO) files were out of sync, vendor and customer data was inconsistent, payroll entries were missing, and the chart of accounts was poorly structured.

Without accurate books, the client lacked a clear financial overview, increasing the risk of errors in reporting and compliance. They required not just a cleanup of past records but a robust structure to manage bookkeeping efficiently going forward.

REQUIREMENTS

• Categorize and organize all bank and credit card transactions in QBO for each entity.

• Create customized charts of accounts tailored to each company’s operations.

• Set up complete and accurate vendor and customer records.

• Reconcile all bank and credit card accounts.

• Record payroll entries with correct expense and liability classification.

• Correct all historical inaccuracies for a clean, reliable starting point.

SOLUTION

1. Comprehensive Transaction Categorization

We conducted a detailed review of every bank and credit card transaction for all three entities. Each uncategorized transaction was assessed, coded to the correct expense or income category, and cross-checked for consistency with the company’s business activities. As a result, the client could finally view accurate profit and loss statements without confusion or missing data.

2. Custom Chart of Accounts Setup

Recognizing that each entity operated differently, we designed a separate chart of accounts for each one. These charts enabled precise tracking of revenue and costs, giving management valuable insights they previously lacked.

3. Vendor and Customer Record Management

We built complete vendor and customer databases in QuickBooks Online, linking transactions to the correct profiles and removing duplicates. This improved visibility into payables and receivables, while also strengthening relationships with suppliers and customers.

4. Bank and Credit Card Reconciliation

All bank and credit card accounts were reconciled against official financial institution statements. We corrected prior discrepancies, addressed missing transactions, and ensured that every balance matched the records to the last cent. This process fixed past discrepancies and established a reliable, accurate reconciliation system for the months ahead.

5. Payroll Recording and Classification

We integrated payroll data from third-party reports and bank records, categorizing wages, benefits, and liabilities with precision. Beyond compliance, this provided the client with an accurate picture of their labor costs, enabling more informed staffing and budgeting decisions.

CONCLUSION

When their previous provider stopped operations, the client was left with disorganized and incomplete records across three companies. Mercurius quickly stepped in, performing a full cleanup and reconciliation in QuickBooks Online to restore accuracy, transparency, and control over their finances.

Today, we continue to manage their bookkeeping with precision and consistency. Their satisfaction has been reflected in multiple referrals to other business owners facing similar post-Bench challenges. With clean books and structured processes, the client now has complete visibility to make timely, informed business decisions.